Precedent Transaction Analysis (PTA) is a valuation method used to determine the value of a company by comparing it to other similar companies that have been sold in the past. This method is commonly used in investment banking and other financial industries to determine the value of a company before making any investment decisions. In this article, we will provide a step-by-step guide on how to perform Precedent Transaction Analysis.

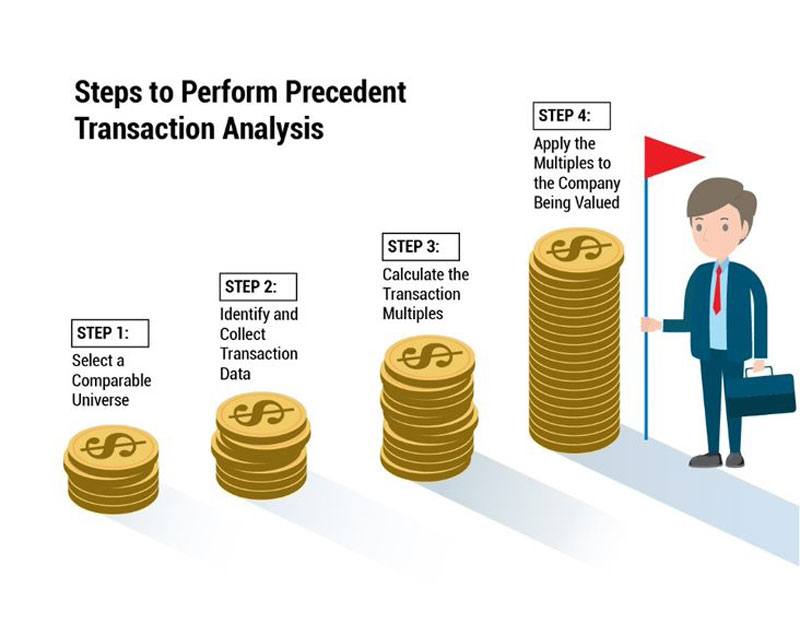

Step 1: Select a Comparable Universe

The first step in performing Precedent Transaction Analysis is to select a comparable universe of companies. The universe of companies should be similar to the company being valued in terms of industry, size, and growth prospects. This universe will be used to identify and compare the transaction multiples of companies that have been sold in the past.

Step 2: Identify and Collect Transaction Data

The next step is to identify and collect transaction data for the comparable universe. This data should include information about the companies that have been sold, the transaction multiples, and any other relevant information about the transaction.

Step 3: Calculate the Transaction Multiples

The third step is to calculate the transaction multiples for each of the companies in the comparable universe. Transaction multiples are typically calculated as the enterprise value (EV) divided by the earnings before interest, taxes, depreciation, and amortization (EBITDA) of the company. Other multiples, such as price-to-sales (P/S) and price-to-earnings (P/E) ratios, can also be used.

Step 4: Apply the Multiples to the Company Being Valued

Once the transaction multiples have been calculated, they can be applied to the company being valued. This is done by multiplying the relevant transaction multiple by the company's earnings or other financial metrics. The result is an estimated value for the company based on the precedent transactions.

Comparable Company Analysis (CCA) and Precedent Transaction Analysis (PTA) are two commonly used valuation methods in the financial industry. CCA involves comparing a company to other publicly traded companies in the same industry. PTA, on the other hand, involves comparing a company to other companies that have been sold in the past. While both methods have their advantages and disadvantages, PTA is often preferred in situations where there are not many publicly traded companies in the same industry or when there is a lack of reliable financial data for comparable companies.

Suppose we want to value Company X, which operates in the same industry as Company Y, Company Z, and Company A. We can use the Precedent Transaction Analysis method to determine the value of Company X by comparing it to the transaction multiples of the other three companies.

We gather the following information on the companies:

Company Y was sold for $500 million and had an EBITDA of $50 million. This implies an EV/EBITDA multiple of 10x.

Company Z was sold for $1 billion and had an EBITDA of $100 million. This implies an EV/EBITDA multiple of 10x.

Company A was sold for $2 billion and had an EBITDA of $200 million. This implies an EV/EBITDA multiple of 10x.

Now, we can use the EV/EBITDA multiple of 10x as a benchmark for valuing Company X. Suppose Company X has an EBITDA of $75 million. We can estimate the value of Company X as follows:

Estimated EV of Company X = EBITDA x EV/EBITDA multiple

Estimated EV of Company X = $75 million x 10x

Estimated EV of Company X = $750 million

By subtracting Company X's debt from its estimated EV, we can determine the equity value of Company X. Suppose Company X has a debt of $250 million. Then, the equity value of Company X can be estimated as follows:

Estimated Equity Value of Company X = Estimated EV of Company X - Debt of Company X

Estimated Equity Value of Company X = $750 million - $250 million

Estimated Equity Value of Company X = $500 million

This is the estimated value of Company X based on Precedent Transaction Analysis. However, it's important to note that this is just an estimate, and the actual value of the company may differ based on a variety of factors.

Precedent Transaction Analysis can be used to determine the value of a company based on the transaction multiples of other similar companies that have been sold in the past.

Precedent Transaction Analysis is a powerful valuation method that can be used to determine the value of a company based on the transaction multiples of other similar companies that have been sold in the past. By following the steps outlined in this guide, you can perform PTA with ease and accuracy. While PTA is not without its limitations, it is a valuable tool in the financial industry and should be a part of every investor's toolkit.