Introduction

In today's investment banking, it's assumed that decisions, interpretations, and presentations of data must be made with extreme precision. Financial modeling skills help aspiring bankers gain an edge in a field where they create strategic insights, value assessments, and ultimately inform critical decision-making. These are not technical skills, yet are rooted in a fundamental understanding of business dynamics and financial structures. Effortlessly distinguishing oneself in a data-driven financial world in which learning and application of economic modelling skills move at a high pace, one must learn how it's done.

Skill 1: Advanced Excel Proficiency Beyond the Basics

In investment banking, Excel serves as the backbone of complex financial analysis and decision-making. Developing strong financial modeling skills begins with mastering Excel at an advanced level allowing analysts to build robust models, work with precision under pressure, and produce results that meet the high standards of transactional environments. Being efficient at this level requires a clear understanding of structure to produce models that work well and can be checked during audits.

-

Dynamic Named Ranges and Array Formulas: Using Dynamic ranges increases a model’s flexibility, which is particularly useful in situations where data changes over time. If array formulas are used, analysts can calculate numerous outputs simultaneously for models to adjust to new data.

-

Modular Structure and Error Management: Every professionally written model should be broken down neatly into inputs, calculations, and outputs. By using IFERROR(), the model can function properly even when data is incomplete or errors occur, thereby avoiding a break during client reviews.

-

Keyboard Shortcuts and Efficiency Techniques: Responding quickly is essential. Shortcut keys make you faster and safer when examining formulas in things that need rapid attention.

Example:

=IFERROR(INDEX(Revenue_Table,MATCH(A5,Product_List,0),MATCH(Year_Input,Year_Header,0)),"N/A")

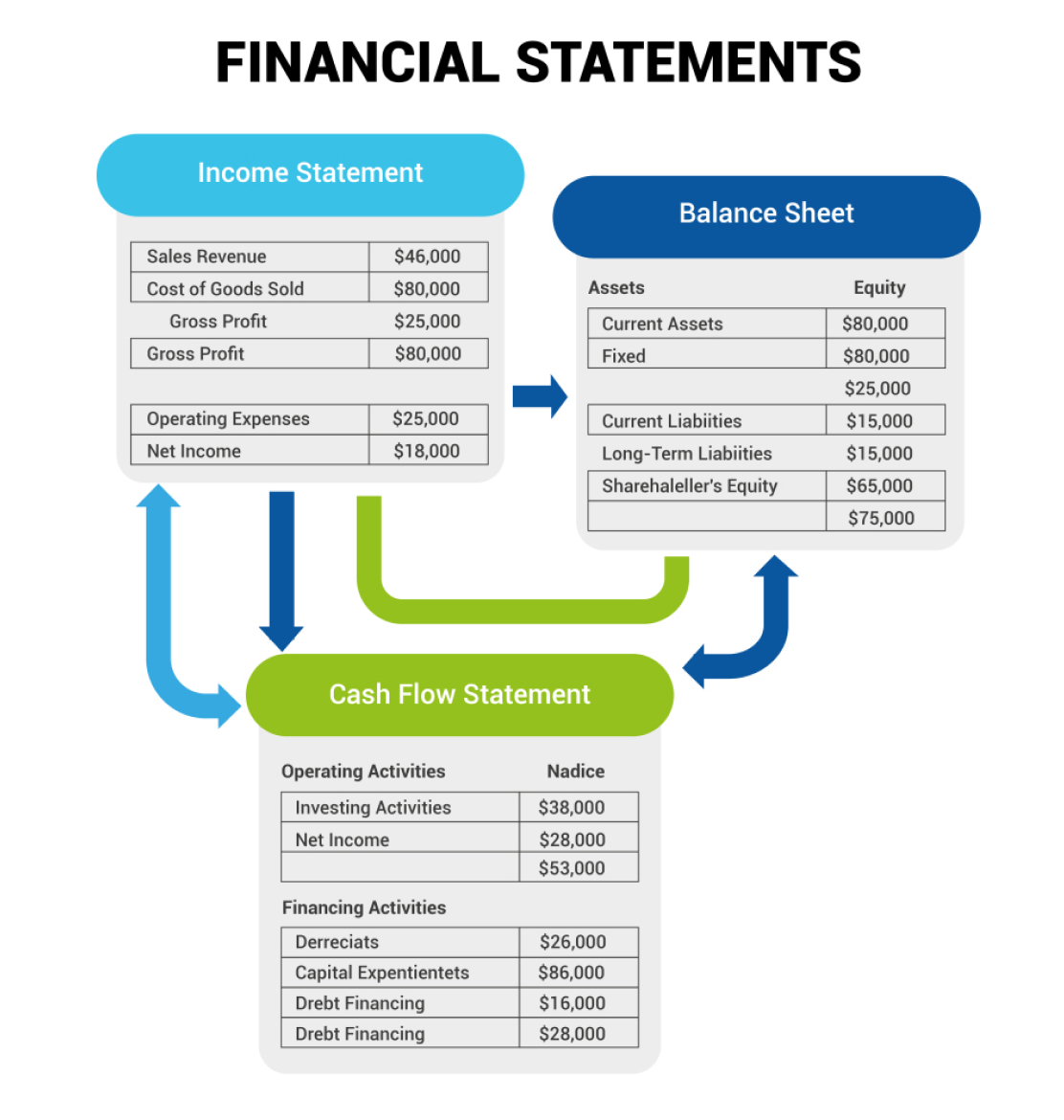

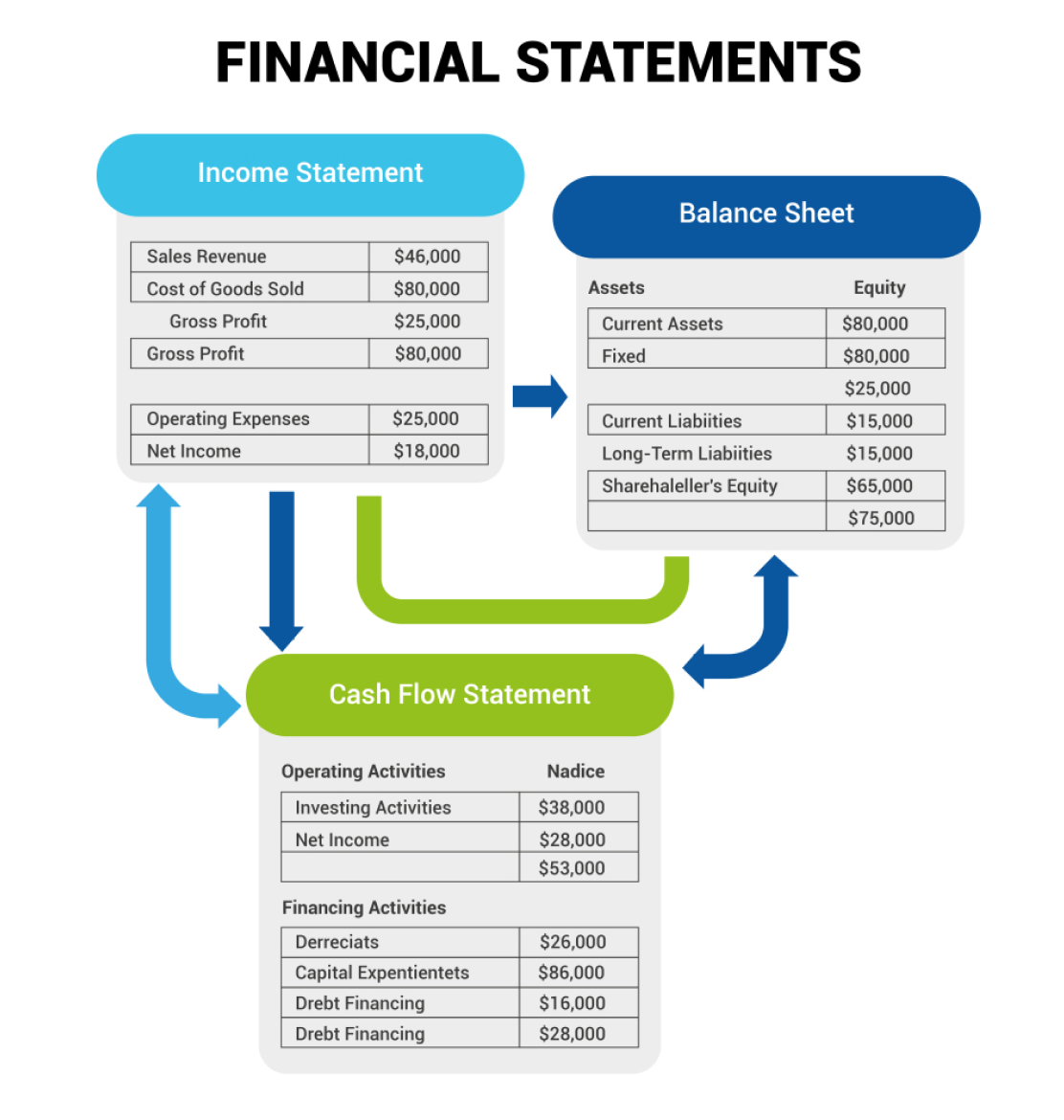

Skill 2: Mastery of the Three Financial Statements Integration

A well-built model always begins with uniting the income statement, balance sheet, and cash flow statement. Investment bankers should be able to examine each financial statement and understand how they interrelate with one another. This ensures that monetary transactions are accurate, support the company’s value assessment, and accurately reflect all its key results.

-

Linking Statements for Dynamic Interdependence: A good model will demonstrate how a modification to one statement influences other statements. For example, the income statement’s net income is added to retained earnings on the balance sheet, initiating the process for preparing the operating cash flow in the cash flow statement. Linking financial information adequately helps analyze the effects of changes in revenue, costs, or taxes.

-

Managing Circular References and Iterative Calculations: Interest incurred on debt, along with its balance, typically causes circularity. Dealing with these loops requires detailed calculations or the use of switch cases, particularly in financial models, such as those involving debt or minority interest roll-forwards.

-

Ensuring Consistency and Auditability: Every reference and output should be easily trackable due to consistent linking and logical setup. The proper use of an integrated model enables better audit processes and easier scenario testing than traditional models, facilitating real-time transactions.

Skill 3: Business Logic and Operational Driver Modeling

The core skills in high-impact financial modeling involve applying and understanding business logic. It requires the level of detail to replicate a company’s actual operations within a model, allowing abstract financial metrics to be translated into actionable strategic insights. It is not just about inserting formulas, but also about building the logic flows that depict the ecosystem, the way business units work, how revenue is generated, and how costs behave under certain conditions.

-

Translate Operations into Drivers: A Robust model starts by identifying the proper operational drivers, such as customer acquisition rates, unit economics, churn, production capacity, or pricing tiers. These inputs must therefore be directly related to the company’s revenue, cost of goods sold (COGS), and operating expense structure, which can react quickly and dynamically to changing business conditions.

-

Build Scalable, Dynamic Structures: Dynamic modeling does not hard-code values but relies on assumption tables and interlinked calculation blocks to create a scalable framework. This guarantees that the model will still work efficiently for forecasting horizons or for corporate strategies (i.e., geographic expansion or vertical integration).

Skill 4: Valuation Modeling Expertise (DCF, Comparable Company, and Precedent Transaction)

Valuation modeling skills are fundamental in financial modeling, particularly for roles in investment banking, equity research, and mergers and acquisitions. All three methods Discounted Cash Flow (DCF), Comparable Company Analysis (Comps), and

Precedent Transaction Analysis have their uses and require thorough mastery to produce accurate and supported outcomes.

-

Discounted Cash Flow (DCF): This approach involves estimating intrinsic value by discounting future free cash flows using an appropriate weighted average cost of capital (WACC). Proper forecasting, accurate WACC assumptions, and precise terminal values are crucial, as even a slight shift in any of these can have a significant impact on the valuation.

-

Comparable Company Analysis (Comps): To assess a company's valuation relative to its peers in the sector, multiples such as P/E or EBITDA ratio are used. The use of accurate peer selection, normalization, and an understanding of market movements helps the model match actual comps.

-

Precedent Transaction Analysis: This approach examines past mergers and acquisitions (M&A) transactions to assess a company's performance. Analysts are expected to offset the effects of deal premiums, control premiums, and the timing of the deal, so they need strong financial understanding as well as attention to detail.

Skill 5: Forecasting and Sensitivity Analysis Techniques

Investment bankers rely on forecasting to project future financial returns using reasonable assumptions. This process helps ensure an accurate representation of how revenue, costs, capital expenditures, and working capital movements are planned and managed. Additionally, sensitivity analysis illustrates how changes in key variables affect metrics like EBITDA, net income, and free cash flow—enabling bankers to assess potential risks and make informed decisions.

-

Multi-variable what-if analysis: Setting up models so their cells connect to assumptions makes it easy to perform different scenarios. Data tables and switch logic enable analysts to examine the impact of multiple key variables changing simultaneously. Because of this, decision-makers can imagine how details of deals or company forecasts might shift over time.

-

Sensitivity matrices for strategic insights: Tables that compare EV/EBITDA with revenue growth can point out the best actions for businesspeople or investors, depending on how the market or the business is performing.

Skill 6: LBO (Leveraged Buyout) Modeling

Private equity investments depend heavily on the use of LBO modeling in investment banking. It means checking if taking out considerable debt to buy a company still allows the equity investors to receive their desired returns. Professionals need to be familiar with debt layering, repayment priorities, and the source of cash.

-

The main features of a core model include debt schedules, interest expense calculations, and minimum cash levels, all of which are managed through a dynamic structure that responds to refinancing and exit assumptions. Analyzing multiples and borrowing influences through sensitivity is key to achieving downside safety and maximizing return on investment.

-

IRR modeling, designing the allocation of profit, and planning for business exit are crucial in determining whether the deal can succeed and maintaining a capital structure ready for the 3–7 year holding period.

Skill 7: Scenario Planning and Monte Carlo Simulations

Investment bankers can utilize scenario planning to evaluate various economic conditions using their financial models, thereby facilitating a deeper understanding and informed decision-making. Stochastic elements are included in Monte Carlo simulations, which creates a significant number of possible outcomes derived from probability distributions.

-

Scenario planning enables organizations to develop effective strategies in response to significant market shifts, regulatory changes, or fluctuations in investment markets. Experts prepare formal best-case, base-case, and worst-case scenarios, incorporating various assumptions about sales, interest rates, and prices. This ability enables firms to predict changes in valuation, their profits, and how they are financed.

-

The repeated random sampling in Monte Carlo simulations helps make sure that risk assessments are more accurate. Using common distributions (such as normal or lognormal) for significant inputs helps bankers construct models that are reliable and believable to others during committee presentations and business deals.

Skill 8: Industry-Specific Modeling (Tech, Energy, Real Estate, etc.)

Customizing models according to each business industry helps ensure accuracy and credibility when working in investment banking. Such a model does not consider the specifics of each sector's factors or the ways they are valued. With this skill, candidates can precisely review companies and describe their findings in a manner that aligns with what stakeholders expect.

-

Technology Sector: Emphasize measuring customer acquisition cost (CAC), the number of customers who leave (churn), and recurring earnings. Plans should include the possibility of quick growth and considerable R&D costs. Many analysts choose aggressive multiples for terminal value because they anticipate future innovation.

-

Energy Sector: Factor in responses to changes in commodity prices, the falling output rate, and cycles in spending on new capital. Modeling must account for the risks associated with regulations, reserve renewals, and the impact of macroeconomic changes on the model.

-

Real Estate Sector: Study net operating income (NOI), capitalization rates, current levels of occupancy, and debt repayment timelines. Every model must feature asset-customized cash flows, important restructuring events, and the end dates of leases.

Skill 9: Presentation-Ready Output and Visual Storytelling

Creating understandable presentations from complicated models is equally significant in investment banking as building the model itself. Critical choices are made more easily and with confidence by clients, stakeholders, and senior executives when visual storytelling is easy to follow.

-

Creating dashboards, graphs, and summaries that convey main insights transforms basic data into actionable reports. Good financial modelers can organize data in a way that makes it easy to read, maintain ample white space, and present different aspects of finances without overwhelming the audience.

-

Creating visuals specifically for analysts, directors, or CEOs ensures that the output aligns with what the audience expects. Using the same layout, structure, and tone for documents as the brand requires makes investment bankers both more professional and quicker in their decision-making.

Skill 10: Automation and Use of Scripting in Models (Python, VBA, Power Query)

Investment bankers must automate and utilize scripts to enhance the accuracy and efficiency of their financial modeling. Automating the same tasks often requires using tools like Power Query, along with scripting languages such as Python and Visual Basic for Applications (VBA). Utilizing this skill helps reduce the time needed and enables more advanced analysis of data within the models.

-

Streamlining Workflow: Automation enhances the process of combining and transforming data, enabling bankers to focus on understanding the final results rather than manually entering the information. For example, Power Query handles both gathering and cleaning data, which reduces the likelihood of inconsistencies.

-

Enhancing Model Flexibility: Manual modeling struggles to handle generating and processing endless scenarios effectively, whereas with Python and VBA scripts, dynamic scenario creation and whole batch processing become possible.

-

Future-Proof Design: Integrating automation into models protects them from market changes and legal updates, enabling them to handle decisions and growth as needed.

Conclusion

Aspiring investment bankers who master these financial modeling skills gain precision, flexibility, and the skills to solve problems they may encounter in the real world. Handling financial reports, organizing scenarios, automating tasks, and aligning models with industry operations all strengthen the impact of decisions. Developing financial modeling skills through practice and collaboration helps professionals stay relevant, flexible, and prepared to offer value in the ever-changing finance field.