A company's Initial Public Offering (IPO) is an important event as it signifies the company's passage from being private to publicly owned and traded. Investment banks are then extremely important in helping businesses navigate the complicated market of investment banking IPOs to enter the market successfully. From pricing to regulatory compliance, investment banks function as a central enabler, assisting companies in marketing through investor interest and long-term growth opportunities in an ever-changing IPO market.

An IPO is how a private company sells its shares to the public for the first time, becoming a public company. It’s an important way for a company to raise capital to help fund expansion, settle debts, or even fund new projects. Investors can even own a piece of high-growth companies by investing in the IPO market.

Key aspects of an IPO include:

Investment banks are key to leading companies through the complex investment banking IPO process, from defining the best time for the sale to managing the offering. They also help to set the initial share price so that the company's valuation mirrors what is expected by the market and makes the most of investor demand. In this regard, IPOs are an important cross-section of corporate finance, investor interest, and market regulation.

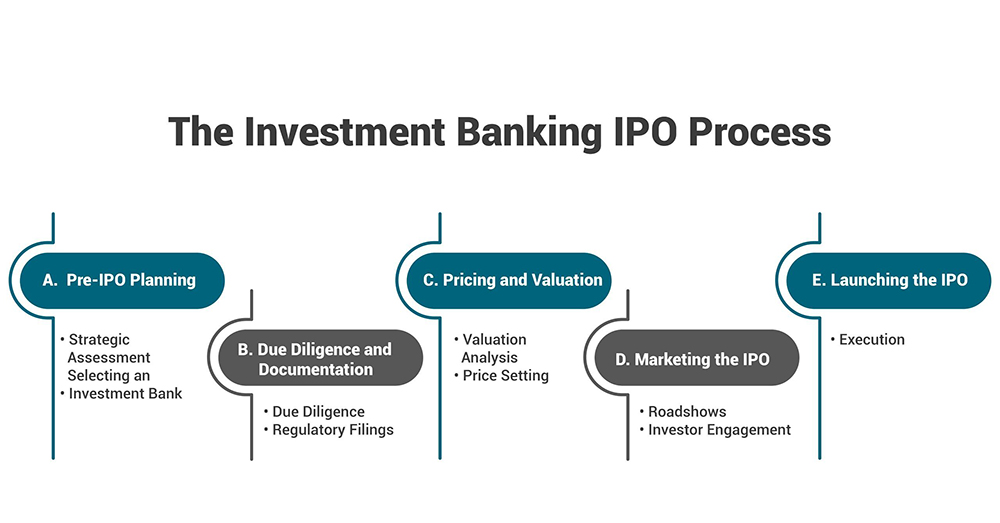

The IPO process of going public is a long and strategic investment banking journey to take a company public. From the decision to list to the day the company first trades on the stock exchange, investment banks lead the way throughout the process. Here's a detailed step-by-step breakdown:

This structured process helps IPO launches succeed, where the investment bank plays a critical role.

Once a company goes public successfully, the job of investment banks is not over. After the IPO launch, the company continues to benefit from key support by investment banks to ensure that the post IPO phase remains successful and investor confidence and market performance are maintained.

After the launch, investment banks watch stock performance closely and entails looking into trading volumes, price swings, and overall investor sentiment. Investment banks use this data to offer their clients insights into how the market views the recently publicly traded company and helps to inform trends and areas of concern. Factors influencing post-IPO performance include:

Effective communication with investors remains paramount. Investment banks assist their clients in developing robust investor relations strategies, which include:

As companies grow, they might need additional capital. Secondary offerings are crucial to investment banks' services in helping companies raise further funds at a good market response. This ongoing partnership maintains the company's vitality by keeping investor confidence up and actively supporting the strategic goals of the ever-changing IPO market.

Technological advancements, regulatory changes, and investor preferences are leading to changes in the IPO market. Investment banks must embrace these shifts to keep up and efficiently serve their clients.

Another growing trend in investment banking IPOs is using special purpose acquisition companies (SPACs). Instead, SPACs currently provide a more loosely regulated route to the public markets for private companies considering merging with shell companies to bring their businesses public. In addition, this trend has attracted much interest from technology startups wishing to achieve a quick infusion of capital.

Key trends include:

With the IPO market changing, investment banks must approach innovation and flexibility to continue to offer the value and insight these companies and investors will need. This adaptability will be necessary to ride the future of the investment banking IPO process.

Investment banks have an important function in the investment banking IPO which helps companies through the process of floating shares in the market. Their skill base covers planning and pricing pre-IPO, the launch of the IPO, and the post-IPO activities, all into the IPO market. With SPACs and direct listings, the landscape's evolution is another trend we continue to adapt to as investment banks, with the focus still on points of relevance and strategic insight. This partnership is crucial for their continued success in driving successful IPOs and helping to define the future of public offerings in a more competitive market.