In the ever-changing landscape of finance, having a strong foundation in portfolio management, asset management, corporate finance, investment analysis, capital markets, accounting, and business is highly beneficial. Today, a degree alone may not be enough to ensure a successful career in finance; an additional catalyst is essential for accelerating your career growth.

Whether you're currently building your career in investment banking or desiring to start a career in finance, opting for the best finance certifications in the market will unlock lucrative and fulfilling opportunities in the finance industry.

Understanding What Finance Certifications Are

Finance certifications are professional credentials that recognize an individual's expertise and competence in various areas of finance. These qualifications encompass a wide range of topics from financial analysis to risk management— and are designed to provide professionals with the knowledge and skills needed to excel in their respective fields. To enhance your career in finance, these are highly regarded in the industry, and individuals who hold them are highly sought after by employers.

Advantages of Getting a Finance Certification

Obtaining a finance qualification is an effective step in enhancing your career in investment banking or finance. These qualifications help equip you with specialized skills taught by experienced professionals and improve your practical expertise, making it a pivotal step in your finance career.

- Acquisition of Practical Skills: Finance credential means gaining practical skills, from spreadsheet proficiency to the ability to conduct in-depth financial analysis. You'll learn from seasoned professionals with years of company analysis experience.

- Excel and PowerPoint Proficiency: Financial modeling qualifications often place a strong emphasis on Excel skills. These cover everything from keyboard shortcuts and formulas to dynamic functions, enhancing your proficiency in Excel and PowerPoint.

- Professional Credibility: For a thriving career in finance, you need to prove your credibility. Best finance certifications equip professionals with the most up-to-date industry knowledge, enabling them to adapt to the dynamic landscape of finance.

- Career Advancement: Finance qualifications open doors to higher-paying roles and greater responsibilities.

- Networking Opportunities: Certifications usually grant membership to professional organizations, offering valuable networking opportunities, mentorship, and a supportive community of peers in the field.

How To Choose the Right Finance Certification?

When advancing your career in the finance industry or investment banking, obtaining the best right finance certification can be a game-changer. Not only does it demonstrate your expertise and commitment, but it also opens doors to new opportunities. But how do you choose the right finance certification?

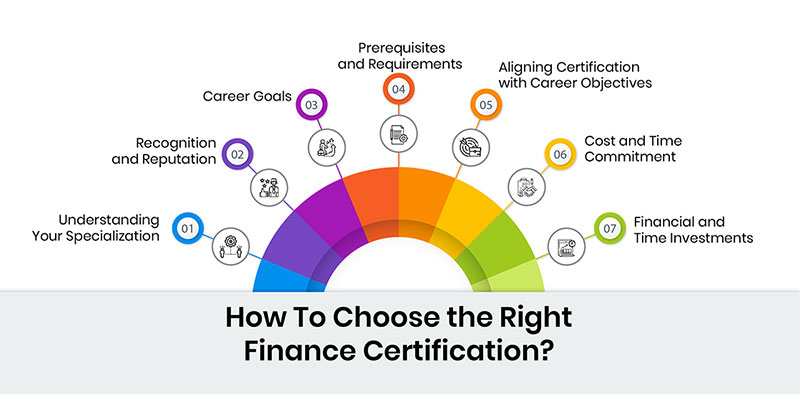

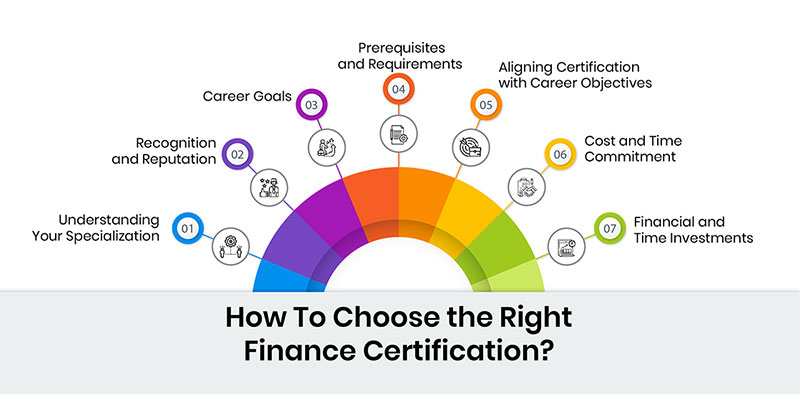

Here are key steps for making the right selection in finance certification:

-

Recognition and Reputation

While looking for the best finance certifications, you must first consider the recognition and reputation of the chosen credential. Opting for qualifications with a solid reputation can enhance your marketability and increase the likelihood of career success. Certifications that are widely acknowledged serve as badges of competence and expertise— like CIBP™— make you more attractive to potential employers.

-

Career Goals

It is quite essential to map out your career goal when deciding on a finance certification. Research thoroughly about the job positions, which you are applying for and choose the right kind of qualification which closely adheres to your career goals. This will be highly useful for obtaining the desired career outcome.

-

Prerequisites and Requirements

It is important to know the prerequisites and certain requirements before choosing any finance qualification.

Different qualifications may necessitate distinct educational backgrounds, professional experience, or the successful passage of a challenging examination. As a prospective candidate, you should meet these prerequisites and requirements before embarking on your journey.

-

Aligning Certification with Career Objectives

The utmost importance lies in aligning the chosen certification with one's career goals. It is quite essential to map out your career goal when deciding on a finance certification. You can do this by researching thoroughly the specific job positions and employers requiring a particular qualification. This step ensures that the opted pursued aligns with the desired career outcome.

-

Cost and Time Commitment

The financial and temporal implications of obtaining a qualification should not be overlooked. They also come with varying costs and time commitments. Individuals should weigh these factors against the expected benefits before making a decision. Furthermore, the duration and requirements of these can change significantly, along with the cost required.

-

Financial and Time Investments

When pursuing these, it is crucial to notice that different programs have diverse financial costs and time commitments. You should meticulously assess these two factors with the anticipated benefits before finalizing your decision.

How CIBP™ Will Help You in Your Career?

A globally recognized qualification is your key to a dynamic and rewarding investment banking career. With the knowledge, skills, and industry recognition it brings, you'll be poised for success in a field where excellence is the standard. Starting this journey with CIBP™ will take your career in finance and investment banking to new heights.

-

Maintaining Professional Standards

The Chartered Investment Banking Professional (CIBP™) qualification, by IBCA, sets and promotes rigorous professional standards for individuals aspiring to excel in the field of investment banking.

-

Comprehensive Framework

CIBP™ is built upon the IBANX™ framework, which is the result of extensive market and technical research. This covers all the knowledge and skills essential for excelling in various critical roles within the investment banking industry.

-

Seamless Examination Process

CIBP™ exam is a 90-minute assessment that comprises 50 multiple-choice questions drawn from a body of knowledge that defines the important understanding required for aspiring Investment Bankers. The seamless exam process allows you to complete it online, using your own system, at a time that aligns with your schedule.

-

Building Future-Ready Bankers

The ultimate goal is to cultivate a strong pool of investment bankers like you, who are well-prepared to face challenges and deliver excellence in their roles.

-

Competitive Edge

CIBP™ equips finance professionals with the knowledge and skills that mirror the industry's best investment bankers. This competitive advantage is essential for excelling in the highly demanding global investment banking sector.

-

Global Relevance

CIBP™ is an international qualification recognized worldwide, making it ideal for finance and MBA graduates seeking to prove their readiness for complex roles in global investment banks.

-

Career Multiplication

Completion of the CIBP™ broadens career possibilities, enhancing your prospects in investment banking advisory, underwriting, M&A, sales, trading, and financial analysis.

-

Industry Collaboration

As a candidate, you can benefit from the insights of numerous industry experts, including investment bankers, valuation experts, private equity firms, asset managers, and many others, to stay aligned with the latest industry standards and practices.

Final Thoughts

In conclusion, the finance industry has evolved to a point where a mere degree is no longer sufficient for building a successful career, especially in fields like finance and investment banking. Taking among the best finance qualifications has become integral for those looking to stand out, enhance their skills, and access exciting career opportunities. Pursuing the CIBP™ qualification offers finance professionals or graduates like you a significant advantage in this competitive world of finance and provides opportunities across various sectors within the industry.