In the arena of corporate finance, Leveraged Buyout (LBOs) is a particular subset of complex yet powerful transactions that can entirely transform businesses. LBO, or leveraged buyout, involves the acquisition of a firm by an investment group which will then fund the acquisition with significant cash balances borrowed from banks and other institutional creditors. Through an in-depth examination of the Leveraged Buyout, an investor can gain plenty of expertise, which will consequently lead to the making of educated choices, especially regarding spotting chances in this complex world of business.

This article brings a clearer picture of the LBO and its definition, stages, pros, and cons, and gives an example of LBO for deeper understanding.

LBO is a purchase by getting the highest number of borrowings mainly secured by the assets of the target company and thus becoming the collateral for the loan. It involves the investor, usually a private equity fund, bringing a small amount of equity capital that is, in other words, the investment being highly leveraged.

The main elements of an LBO involve leveraged financing to cover the acquisition, the achievement of returns via adjusted operations and technical approach as well as a possibility of substantial financial reorganization.

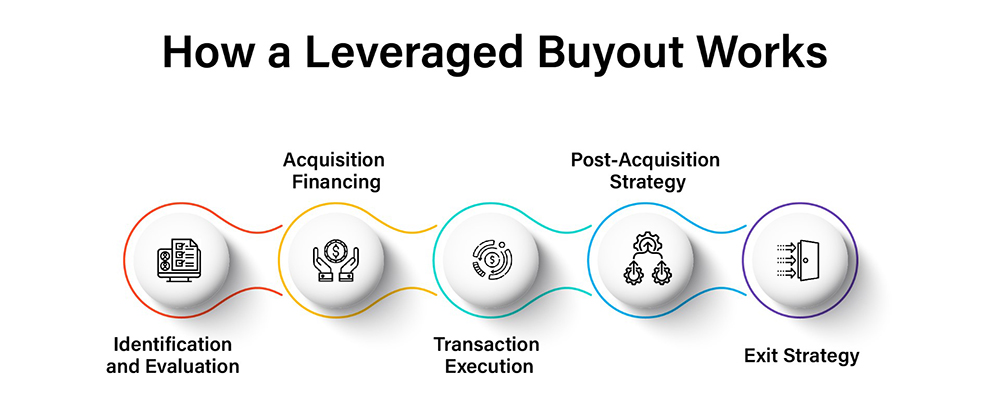

LBO (Leveraged Buyout) is a multi-dimensional and goal-oriented process that needs a lot of planning, analysis, and thorough execution. Learning how an LBO operate is deeply important for investors, financial professionals, and business leaders who must go beyond to apply this transactional method in their operations.

Identification and Evaluation: The first stage in an LBO is the determination as well as the appraisal of the target company that fulfills the proposed owner’s investment objectives. The due diligence of the process is, in fact, extensive, which involves scrutinizing the target’s financial status, market outlook, growth trajectories, as well as the probability of value added.

Acquisition Financing: Upon identifying the target company, securing the necessary financing is the following step in the process of acquisition. LBOs rely on equity financing from their investors and on debt funds from banks or any other institution that deals with financial services assignments. Leverage enables investors to purchase a significant equity proportion of the target company with a tiny upfront equity sum, thus securing control.

Transaction Execution: Once financing is set, then the investor goes forward to negotiate the deal of acquiring with the target company management and board of directors. This covers the valuation of the business, the structuring of the deal, and the execution of the legal documents. The deal is regularly structured as acquisition financing through the channels of the target company’s assets as collateral for the borrowing of money.

Post-Acquisition Strategy: As a post-acquisition step, the investor collaborates with the management team of the acquired company to achieve all their planned goals such as the improvement of the company's operational efficiency, the growth of sales revenues, and the maximization of profitability. This could regard the application of systematic contingency, multinational diversification, or innovative activities.

Exit Strategy: The main aim of an LBO is to bring in some profit for the investor in the end. Through the various exit strategies, such as selling the company, the company going public via an initial public offering (IPO) or the company undergoing recapitalization, profits for the investors might be. The timing and method of exit will be dictated by the market conditions, the realization of targets, and the individual’s investment aims among many other factors.

LBO comes along with numerous advantages that investors need to consider before undertaking them. Here's a detailed look at the advantages of a Leveraged Buyout:

Potential for High Returns: Rapidly appreciating investment is one of the type outcomes of the Leveraged Buyout that can pay off handsomely to the investors by employing debt to boost the profit on equity cash-in which can produce reasonable risks-adjusted yields.

Alignment of Interests: Private equity firms often take a hands-on approach that emphasizes both the management and the growth of the entities they acquire. Meanwhile, by linking their interests to those of the management and employees of the companies, there are emerging collaborative strategies that develop an atmosphere of harmony directed towards the accomplishment of shared business goals.

Access to Capital: An LBO allows companies to gain access to a considerable amount of money that they may not get from the traditional equity financing method, thus a company can venture into many growth opportunities, acquire more equipment to expand production, and make strategic moves to enhance the long-term value of the firm.

Operational Improvements: Private equity ownership can contribute to the strategic implementation of activities with operational expertise and resources required for the company's performance improvement, such as cost minimization, profit growth, and revenue increase, its result is positive for all parties involved.

However, a Leveraged Buyout also carry inherent risks:

High Levels of Debt: With the extensive employment of debt-dependent Leveraged Buyouts, companies could encounter a financial problem whenever the company’s cash flow turns negative when the economy becomes worse, or an industry decreases in demand.

Operational Challenges: The implementation of success plans or growth initiatives after the acquisition is not a guaranteed success, might result in operational risk, and should be carried out with utmost care, execution, and continuous monitoring to avert operational risk and ensure long-term sustainability.

Market Volatility: Leveraged buyout sneak under the wheels of market fluctuations and economic downturns, and those factors may be consequent on the quality and valuation of the targeted company; then the whole transaction and the hopes to achieve the maximization of the leverage returns may face uncertainties.

Regulatory and Legal Risks: LBO is also concerned with regulations and law, thus is subject to antitrust regulations, environmental regulations, and some contractual obligations. An LBO may act as a variable in the deal process and pose various threats to the transaction’s success.

One of the most famous leveraged buyouts that subsequently marked a historical high point was the purchase of RJR Nabisco from Kohlberg Kravis Roberts & Co. (KKR) in 1989. This now-hallowed chapter in the history of the corporate takeover wave immortalized in the book "Barbarians at the Gate" and a subsequent movie with the same title, captures the last glimmer of the era's corporate excesses.

KKR and several investors in 1988 took over RJR Nabisco at a USD 25 billion price with only borrowed funds. The acquisition is funded by a debt-to-equity proportion with the debt option bringing its debt component to new heights.

While the initial feasibility of the RJR Nabisco deal looked favorable with the excellence of the tobacco and food industries, the company faced some challenges within its management and the operation environment. Such difficulties, together with the deteriorated credit conditions, completely triggered RJR Nabisco's split-off and the sale of all its assets.

The RJR Nabisco Leveraged Buyout becomes one of those examples that show the dangers and complexities of the big leveraged buyout transactions and lead the practitioners to give more attention to proper due diligence, strategic planning, and risk management.

The foundation of the analysis and evaluation of Leveraged Buyout opportunities is the Leveraged Buyout model— a financial model used to assess the feasibility and potential earnings of an LBO transaction. The LBO model integrates several inputs such as the acquisition price, financing structure, cash flow projections, and exit assumptions made for arriving at IRs, and other pertinent financial metrics.

The LBO model can be used to carry out sensitivity analyzes and scenario planning to evaluate how the assumptions and the market conditions influence the outcome of the given investment. It is an important assessment factor during the LBO period and the decision-making process about the implementation of strategies for risk management.

A Leveraged Buyouts is essential to corporate finance and often allow for value to be created, strategy to be changed, and financial engineering to happen. In addition, it also comes with risks and complexities that require research work and special knowledge to drive them in the right direction. Investors must have clear insights into the nature, process, advantages, and risks of the LBO, after which they can make rational decisions and minimize the unknowns to achieve their target objectives.