Introduction

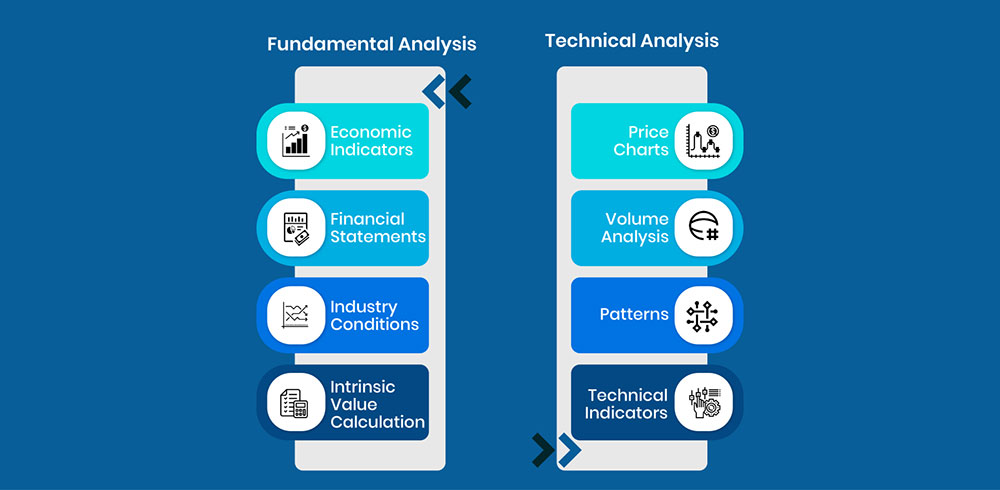

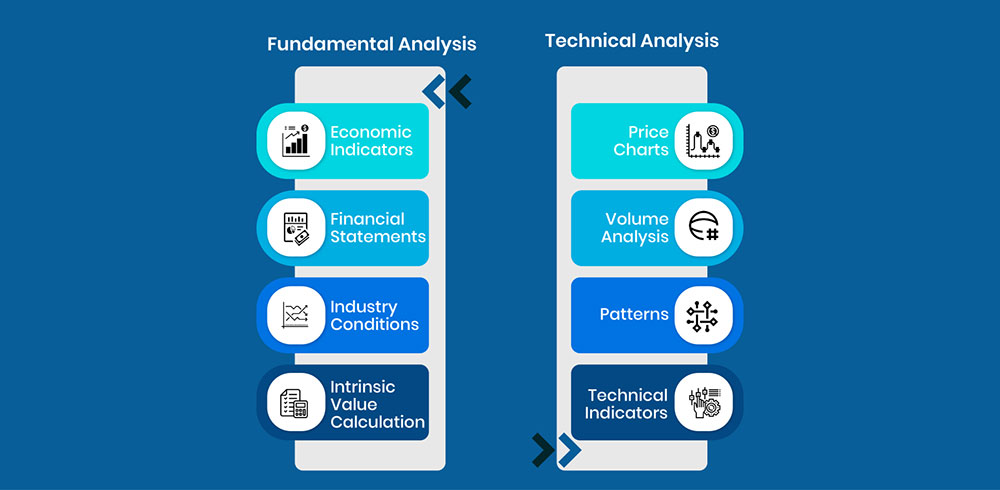

When it comes to investing, one must consider the importance of Fundamental vs. Technical Analysis. These two unique methods assist investors in making informed decisions by using different data sets.

Fundamental Analysis scans a variety of economic factors and the financial statements of a company and the company’s stock, while Technical Analysis scans the price charts of the stock to forecast the trends. Hence, it can be rightfully said that, for individuals planning to build an investment banking career path, having knowledge of both methodologies is crucial. This article explores what Fundamental and Technical Analysis are, how they are implemented, and why they are essential in the current business world.

Understanding Fundamental Analysis

It is essential to grasp fundamental analysis to assess a company’s arguably real value and ,to make a reasonably sound investment decision. Here are four key aspects to consider:

-

1.

Economic Indicators: The monitoring of general economic conditions such as GDP growth, interest rates, and inflation risk that gives specific information about the state of different branches of an economy and individual businesses.

-

2.

Financial Statements: Forecasts financial statements based on balance sheets, income statements, and cash flow statements to assess a company’s liquidity, solvency, profitability, and growth rate.

-

3.

Industry Conditions: It is important to evaluate the position of the company, about its competitors, development trends, and formal or informal constraints in the field in which the company operates to identify the influence of outside factors on performance.

-

4.

Intrinsic Value Calculation: Valuation methods, such as Discounted Cash Flow Analysis and P/E ratio, and the comparison of the calculated worth of a certain company versus market price to determine whether the stocks might be worth more or are trading for more than their value.

Understanding Technical Analysis

Technical Analysis is the general practice of studying the future behavior of the market based on historical reference data, including the price and volume of the stocks. Here are the key components:

-

1.

Price Charts: Technical analysts rely on graphs that chart market prices to decipher trend lines and support and resistance levels. These charts are helpful in that they display price history and give traders a basis for predicting the price in the future.

-

2.

Volume Analysis: Volume is a factor used in Technical Analysis. It refers to the extent of activity, that is, the number of shares that transact during a given period. Volume gives the direction of the stock as well as the intensity in trading, and the higher the volume, the stronger the confirmation of the working price move.

-

3.

Patterns: It is possible to navigate for different patterns, such as head and shoulders, double bottoms, and flags, that can help with understanding trends. Trends assist traders in taking appropriate actions based on the previous behaviors of other market players.

-

4.

Technical Indicators: Some tools used to analyze the price data include moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence). They assist the user in ascertaining the extent of overbought or oversold situations as well as probable trend reversals.

Fundamental Analysis in Practice

Fundamental analysis is the study of the company’s financial quality, the state of the sector, and the economy to assess its true value and growth. Let’s look at the step-by-step guide to grasp how it's done:

-

Gathering Information: It is important to start by gathering and compiling various data such as balance sheets and income statements, company reports, and any trade news that may have been published. This information gives the investor a brief indication of the company’s past productivity and its viability for the future.

-

Analyzing Financial Statements: Research deep into the company’s financial statements including income statements, balance sheets, and statements of cash flows. To begin with, try to find out trends, unusual occurrences, and key financial ratios that may speak about the company’s financial health.

-

Assessing Industry Conditions: Next comes knowing the company’s line of business, its market, competitors, and regulatory environment. Industry analysis is essential as it assists in determining the company’s ranking in its business segment.

-

Evaluating Management: Evaluate the management team and their performance, skills and past choices, and the organization’s central strategies. The role of effective management is one of the core determinants of the success of a business venture.

-

Calculating Intrinsic Value: Some of the most used models include the discounted cash flow (DCF) or the price-to-earnings (P/E) models to measure the company’s inherent worth. To estimate the potential of the given security as an investment, use the current price of the company’s stock.

Technical Analysis in Practice

Technical Analysis is useful to traders who trade based on short-term trends in the market. Let’s examine the main steps involved in conducting Technical Analysis:

-

Charting and Graphs: When beginning the analyzes, traders must primarily focus on price charts and graphs that capture the past price action of a security. Some of the most used types of charts are line charts, bar charts and candlestick charts.

-

Technical Indicators: There are technical indicators that can be used to analyze stock performance such as moving averages, relative strength index (RSI), and Bollinger Bands. It also uses them to determine the points of entry and exit about the price and market momentum.

-

Trend Lines and Patterns: The next step is preparing trend lines on the graph to define whether the market is moving up or down. Head and shoulders chart, triangle chart, and double tops/bottoms to make future prices and possible breakouts.

-

Volume Analysis: Use trading volumes to affirm the rates. Low volume during a price rise means that there is weak evidence for an upward trend whereas high volume during a price decline means that the downtrend is very evident.

-

Trading Platforms and Tools: Lastly, take advantage of trading interfaces that include diverse tools of analysis and live data. These platforms are used for testing trading strategies and making transactions with the help of given technical indicators.

Impact on Investment Banking Careers

Fundamental vs. Technical Analysis plays a significant role within the framework of an investment banking profession. Below are four key roles that these analyzes play:

-

1.

Investment Decision-Making: Equity research, mergers and acquisitions, and portfolio management activities are some of the areas where Fundamental Analysis is used by the investment bankers to determine the intrinsic value of the companies. Besides, technical Analysis assists in identifying the time to enter and exit the market.

-

2.

Risk Management: A combination of the two analyses is necessary for effective risk management. Fundamental Analysis involves the evaluation of potential long-term threats that can be posed by a company’s poor financial position and/or unfavorable position in the market. Technical Analysis gives an outlook of short-term fluctuations in the market, thus assisting in avoiding some of the risks with timing of the market.

-

3.

Client Advisory Services: Investment bankers give their expertise regarding the proper investment decisions to make based on Fundamental vs. Technical Analysis. This two-pronged effort assists to match solutions to clients’ requirements, for those who want sustainable growth as well as those who are interested in short-term profiteering.

-

4.

Trading Strategies: In trading, Technical Analysis is used to understand patterns and trends for short-term trading or a particular day. On the same note, fundamental analysis complements the formulation of intermediate to long-term trades by aiding a trader in comprehending the value of the underlying assets.

Conclusion

Analyzing the differences between Fundamental vs. Technical Analysis is the most important factor benefitting investors to make informed and better investment decision. The strengths of both concepts are that each gives a different view of the market, and their combination draws a full picture of the situation that is being analyzed. It must also be noted that being familiar with such analyses improves the ability to develop a strategy and assess potential risks among investment banking professionals. Thus, the focus should be on the perpetual acquisition and utilization of knowledge in both methods for positive results in the financial industry.