These could be early days for many investment firms and financial institutions to deploy AI and ML technologies for fighting financial crimes. Employees may be trained to a certain extent to identify and monitor suspicious activities. Larger institutions might even have a dedicated team for it. But the real difference lies in AI and ML deployment! IBCA discusses the indisputable benefits of using AI and ML in fighting financial crimes here.

Money laundering is more common in investment firms and it is important to have the right Anti-money laundering (AML) procedures in place. The solution is available by implementing Artificial Intelligence and Machine Learning at various stages as applicable, enabling anti-money laundering checks.

From the 2001’s FATF - Financial Action Task Force (FATF) to 2021’s Anti Money laundering Act – the efforts to curb money laundering have been many. Yet, we find instances in history where we witness banks paying hefty amounts of money as penalties.

From the News:

Deutsche Bank’s AML failures led to merit penalties of £163 million by the UK Financial Conduct Authority (FCA) and USD 425 million by the New York State Department of Financial Services.

HSBC paid a fine of USD 1.9 billion because of their inefficient control processes to catch suspicious activities.

‘Troika Laundromat’- the name given to a collection of 70 offshore shell companies, is another deadly scandal to mention. The controllers used them to move billions of dollars- $4.6bn (£3.5bn) of private wealth from Russia to the West.

The financial crimes are alarming!

From Danske Bank to Swedbank, Deutsche Bank to ING, no institution appears to be safe from the clutches of the financial criminals. Money laundering is one of the prevalent and damaging forms of crime that plagues our global economy.

About 2-5% of global GDP is laundered each year, which equates to USD 800 billion-USD 2 trillion, UN’s Office on Drugs and Crime reports.

To combat the situation, investment banks and financial institutions are looking forward to technology-enabled methodologies to detect suspicious activities and proactively prevent the spread of laundered funds.

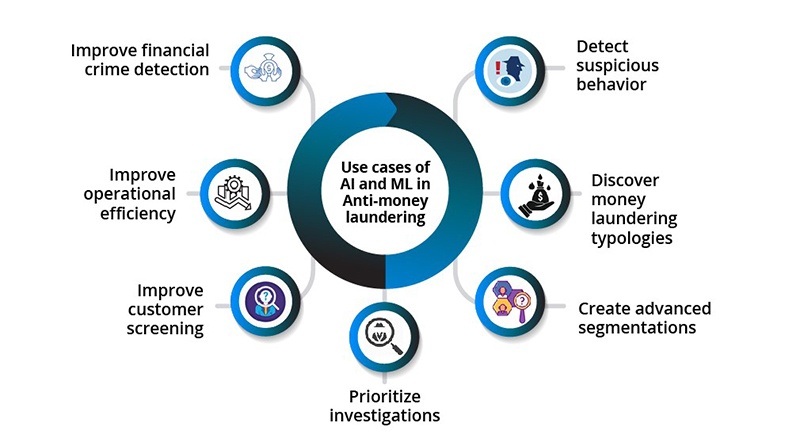

The implementation of Artificial Intelligence (AI) and Machine Learning (ML) systems can help the investment banking industry and other financial services sectors to detect money laundering activities and evolve their compliance obligations. AI can perform AML tasks faster while machine learning can adapt to the new threats and new methodologies involved in money laundering and enable firms to reposition quickly in varying regulatory environments.

What is this AML Artificial Intelligence and Machine Learning all about?

Artificial Intelligence (AI) implementation in the AML program represents a set of algorithms that detects money laundering and controls the digital measures. The AI algorithms can analyze the customer data, customer due diligence (CDD), transaction monitoring inputs, and sanctions screening to remediate suspicious activities.

Machine learning uses the previously analyzed customer due diligence and transaction monitoring data and scales customer behavior to make an accurate determination.

Before delving deep into its application and advantages, let’s analyze the business situation that prompts the financial industry to implement AI and ML in their systems.

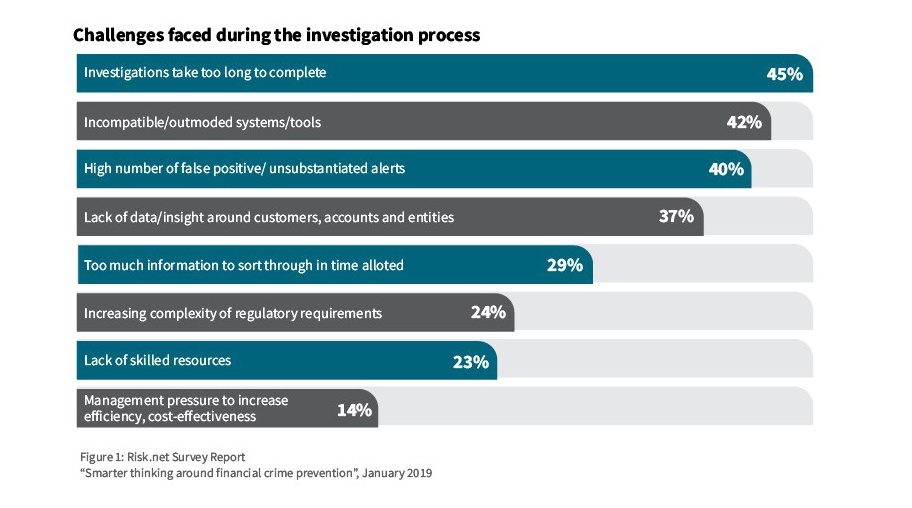

Most financial institutions are continuously increasing their spending on financial crime compliance activities to address the challenges. Still, a host of new challenges keep breaking out. To mention a few, they are:

The criminals are using new and sophisticated techniques to launder money. Advances in technology and data adoption are faster in them as they are instigated by economic and geopolitical shifts.

On average, financial institutions spend about USD 60 million per year to meet their AML compliance requirements. Also, a few of the larger firms are spending about USD 500 million annually to comply with CDD and KYC rules. The increasing cost involved to meet the regulatory demands run the risk of major financial and reputational losses.

Streamlining operations and maintaining controls at its maximum level is a challenge due to new threats, high transaction volumes, and increased regulation.

In this situation, advancements in Artificial Intelligence and Machine Learning will help financial institutions to become more agile and efficient to detect financial crimes.

The need for AI and ML is more as the pandemic has forced financial institutions to complete their deals online. Online transactions create more opportunities for criminals to invade their system. Typically, investment banks were conducting their deal closures and money transactions manually and most of the client interactions were made in physical presence. Here also, knowing the rules inside out enabled money launderers to break into the system easily.

“Financial institutions have been improving their ability to identify customers and monitor transactions by experimenting with new technologies that rely on advanced analytical techniques, including artificial intelligence and machine learning.”

Kenneth A. Blanco, Director of FinCEN, at the 2019 SIFMA Anti-Money Laundering & Financial Crimes Conference

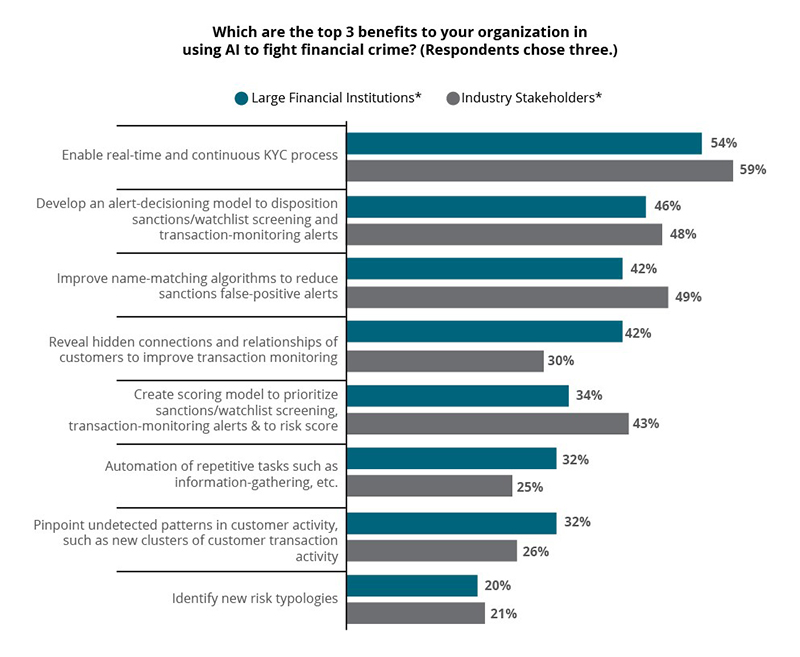

When powered by AI and ML, they are bound to get accurate pictures of their customers. AI systems flag suspicious activities, after which AI advisers provide risk scoring, summaries, and data visualizations. It also reduces false positives. Let’s know more about its advantages.

With advanced analytics and machine learning, one can easily identify the anomalies, new indicators, and patterns of behavior that are linked to money-laundering or other non-compliant behaviors.

Enables to understand the links between risky entities, complex behavior regarding transactions, and cash-structuring.

Identify the suspicious transactions while reducing the size of the investigation teams.

Text mining of documents and watchlist helps to increase compliance by discovering sanctioned/prohibited transactions.

Predictive analytics helps to analyze historical investigations and thus allocate complex cases to the right authorities.

AI/ML models should be explainable for regulatory and management needs so as to better financial crime detection. Also, financial institutions must consider the ethical implications of AI.

Moving forward, let’s understand the impact of using AI and ML in anti-money laundering.

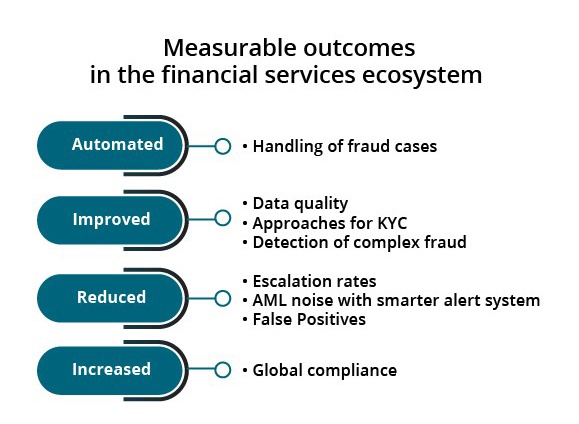

Guidehouse Inc. and Compliance Week in partnership with the International Compliance Association (ICA) polled 300-plus industry stakeholders across the globe and determined the prevalence of ML adoption in fighting financial crime. Take a look.

Likewise, let’s study more about AI and ML implementation benefits through this IBM customer’s case study.

If you are planning to apply AI or other cognitive technologies for anti-money laundering, it could be a daunting task indeed.

The question is-

Which part of your customer base should align with the AI program?

What to do when demands grow faster than budgets?

Is it possible to tie the new technologies into other systems for a cross-channel view?

How do you upskill the existing investment banking professionals?

How to build a pure technical team?

How to protect your reputation and customers?

How to ensure employees are acting in the best interests of the organization?

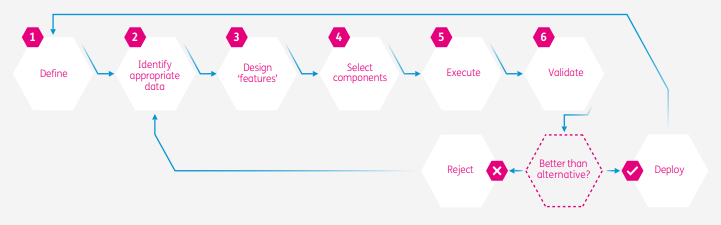

It is recommended to develop a suitable model before deploying these technologies. A typical model life cycle has these components in place.

Source: Machine learning for financial crime professionals, Baringa Partners

To summarize:

Define the purpose of building a model

Identify data that has to be fed for the model so that it can learn and perform optimally.

Design features and enables the model to accurately evaluate it

Choose the most appropriate combinations through the trial and error method

Execute and iterate until the results are appropriate for the defined purpose

Validate the model’s performance

Deploy the model into operational use [else, revise the model until the performance improves]

AI and ML technologies will automate, improve, and optimize anti-money laundering despite the volume, velocity, and variety of your generated data. The time is ripe now to deploy AI and ML solutions in your investment firm’s ecosystem and reduce risk related to financial crimes.

Are you done with AI and ML implementation in your firm?