The field of Finance is a vast area with many career opportunities to work in all sorts of industries and businesses worldwide. It has gained immense popularity among young individuals, becoming highly sought after due to its promising career prospects The median annual wage for business and financial occupations is USD 46,310 higher than the median annual wage for all occupations. Understanding the various job opportunities within the financial sector allows individuals to choose a finance career that aligns with their long-term goals. This article covers an overview of different career paths in finance, and the qualifications required to help take the right decision in choosing the best career in finance.

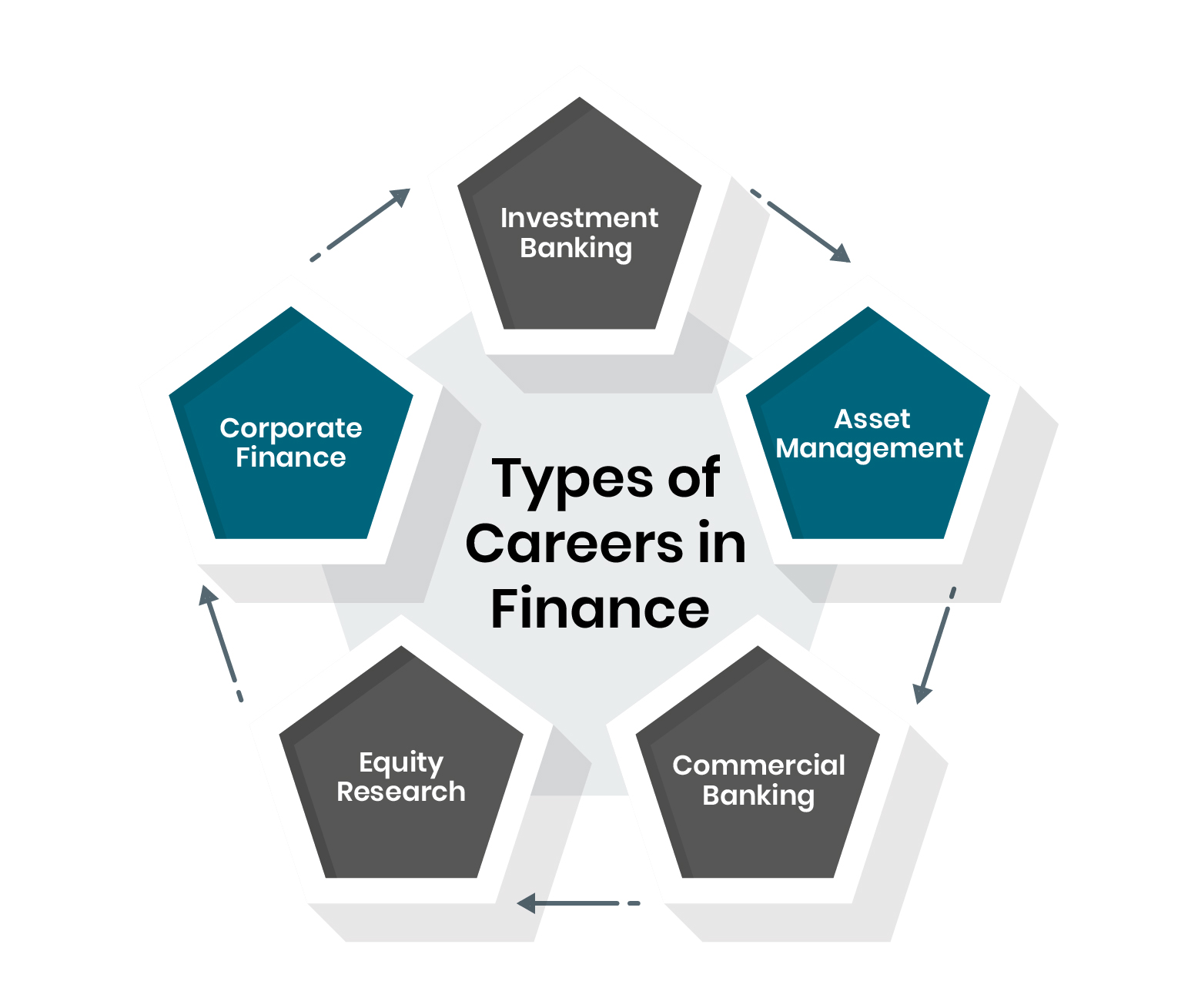

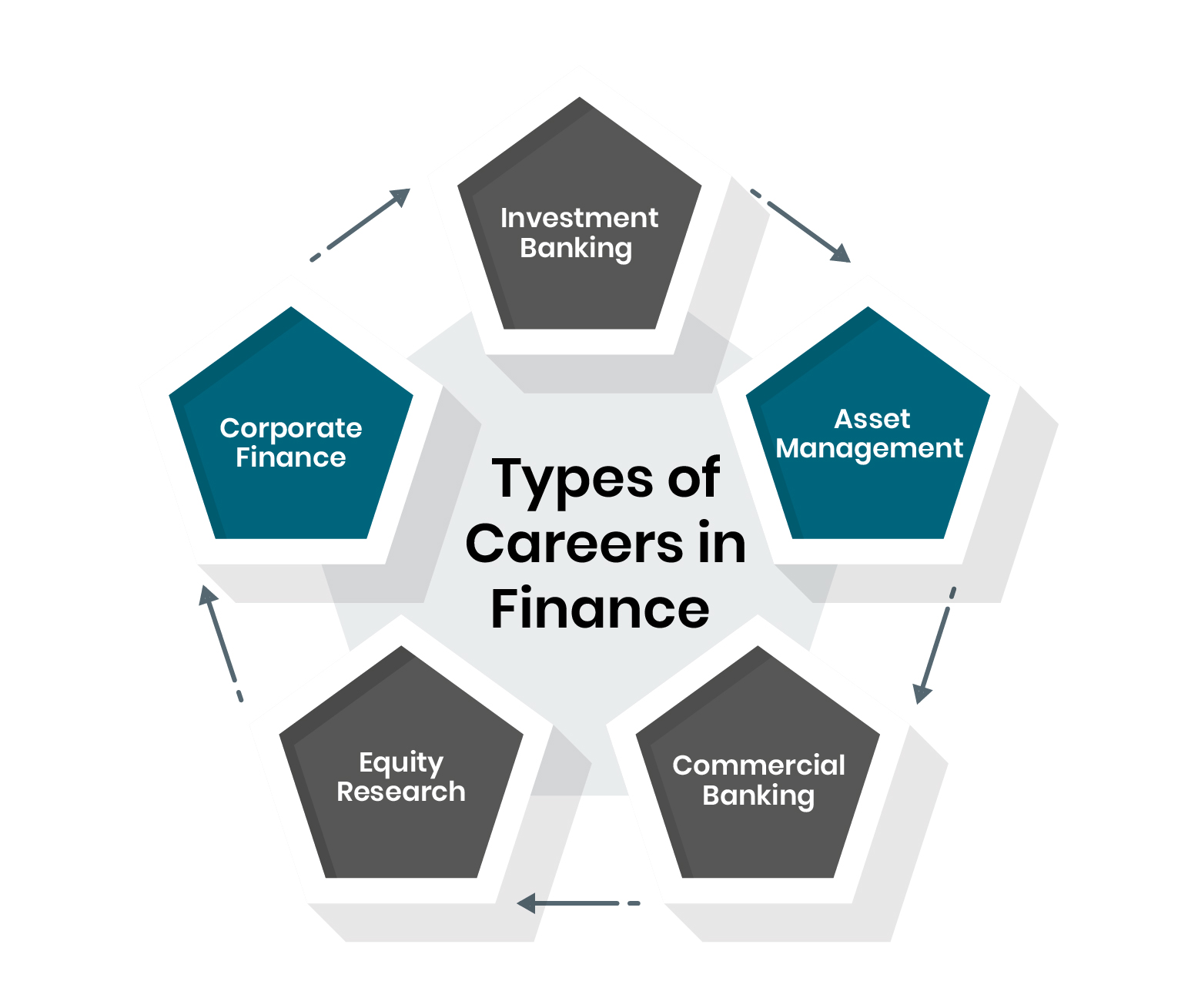

Types of Careers in Finance

Many professionals think that investment banking is only the best option for a career in finance due to its renowned competitiveness and high pay, but there is a vast range of finance career options that extend beyond and offer impressive pay packages.

-

Investment Banking Investment banking is considered among the highly prestigious career options in sector of finance. A career in investment banking is a lucrative path for professional growth and salary package. Professionals in investment banking are responsible for tasks related to financial remodeling. The work consists of data and numbers and introducing decisions that improve the business operations. Keen interest and insightful knowledge of financial markets, economic trends stock analysis, and stock market research will be beneficial.

-

Asset Management Asset Management is useful to well-manage the wealth of High Net-Worth Individuals (HNIs) and institutional clients. In this the identification of suitable avenues of investment for their clients is done to realize the wealth generating goals to enhance and apply long-term investment strategies to gain the same. There are a lot of benefits due to the high demand for skilled professionals.

-

Commercial Banking This career in finance gives major involvement in the retail banking services to businesses and for the professional who want to make mark in their respective careers. A good knowledge of savings accounts, issuing debit or credit cards along with a line of credit based on the creditworthiness of the client will add value.

-

Equity Research Many individuals who are not interested in investment banking careers often Equity Research. It consists of comprehensive analysis of stocks, such as financial modelling and valuation, to help decide the worth of a certain investment. It is useful for individuals, as well as institutional investors, to take critical investment decisions. Equity research also offers insights and recommendations related to investments in stocks or equities. Professionals in equity research mainly work for financial institutions, investment banks, asset management firms, or independent research firms.

-

Corporate Finance Corporate finance mainly deals with funding sources, investment decisions, and capital management and restructuring, and other tasks that are useful to enhance the strategic growth of an organization. A sound knowledge of managing funds, choosing investment portfolios, financial risk management, and forecasting economic updates will be beneficial.

Financial Education: Majors & Degrees

Most financial jobs demand at least a minimum of a bachelor’s degree. Hiring managers usually look for candidates in the entry-level employees who have graduated with a degree in finance or a major in related areas such as accounting, business management or economics. In mid-to-senior level employees usually look for aspiring individuals who have work experience mainly in taking financial decisions or giving financial advice. An advanced degree such as an MBA or professional development best finance certifications are also useful for an individual who works in financial services and is seeking ways to enhance their career opportunities.

Which Finance Career is Best for You

A career in finance from an unrelated field can be tricky but not a difficult one. An aspiring individual must be familiar with the recent updates and advancements that are happening in the finance industry. A sound knowledge of financial regulations will also enhance the chances of success when applying for a job or attending an interview. Whether one aims to be a part of an investment bank, commercial bank, private equity sector or in the finance department of an organization, it is quite necessary to understand finance sector functions and their essentiality for the growth of any business.

How Can the CIBP™ Help Me?

Chartered Investment Banking Professional (CIBP™) is a well-recognized qualification provided by Investment Banking Council of America (IBCA). IBCA credentials and standards provide the professionals to stay attracted with the latest industry developments to their best. CIBP™ exam is worth choosing because it is among the world’s most uniquely crafted powerful charter from United States.

CIBP™ exam is uniquely crafted powerful charter that prepares an individual for a quick, impressive launch into investment banking, and fosters rapid growth in their career as well.

Top reasons for choosing CIBP™

-

Attractive salaries and more

Choosing a career in investment banking is perfect for the professionals' candidates who are interested in facing challenges as they will tackle an analytical job role and the benefits that come with it, especially high pay checks. It is demanding, yet itmanages to lure business and quant new members around the globe. Apart from, attractive salaries and bonuses, investment banking industry also givescommendable perks such as health insurance, vacation, and profit-sharing or retirement packages.

-

Better learning experience

CIBP™ offers better knowledge about the large landscape of contemporary Investment banking. It enables an individual to gain an advanced level of competency in the domain. It develops the ability into the most dynamic and best young international professionals validating the aspirants’ potential and capacity to better do the tasks across the entire spectrum of sub-domains within the investment banking industry.

End Notes

Finance offers vast opportunities, not only in terms of monetary gains but also in understanding the processes of fund accumulation. It is best for those job seekers who can find success with the right mind, qualifications and skill set. Understand these important aspects before deciding to proceed further in your investment banking career.