In 1997, David Pullman, a rock and roll investment banker, pulled a rabbit out of his hat. He pioneered an ingenious financial product – Bowie bond – to monetize the body of work of a famous musician and artist, David Bowie, by selling the rights to his future royalties. It was the first-time a performers’ cash flow potential was used as collateral. Though these bonds lost appeal with the rise of online streaming in the late 2000s, to date they continue to inspire financiers.

Investment bankers are the Houdini of finance who help companies and brands raise funds for growth. They facilitate capital raising activities through capital markets, a part of the financial system where long-term capital is raised by selling securities such as shares and bonds to the investors.

Raising equity capital amounts to selling a percentage of ownership in the company via shares in exchange for funds, and raising debt capital entails selling bonds (a loan), instead of ownership, with a commitment to pay regular interest.

Investment banking heavyweights use their financial prowess and deep industry knowledge to woo potential investors to trade in these debt and equity instruments.

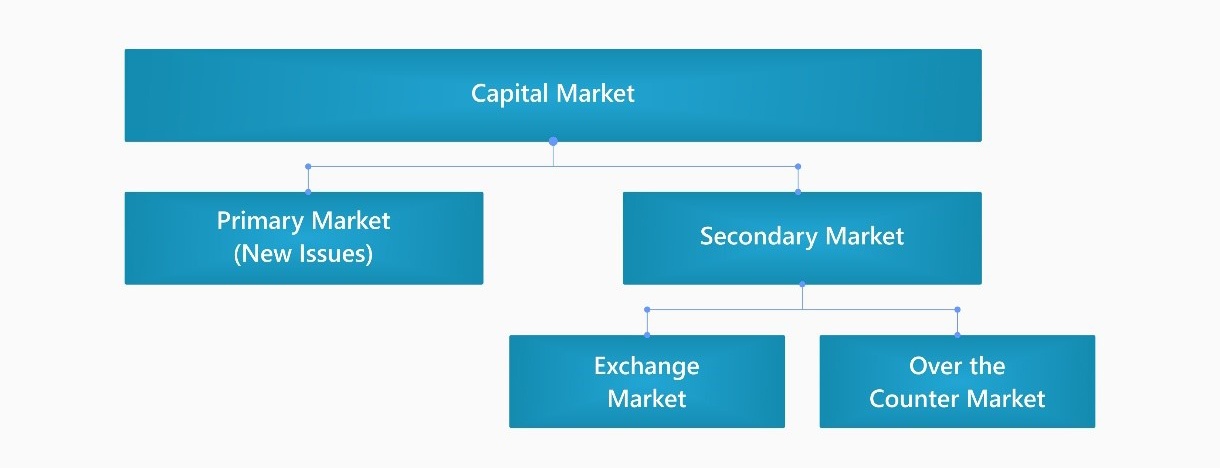

Capital market is structured in two segments – primary and secondary. When a private company opens its ownership to the public by selling new shares through stock exchanges – NYSE, NASDAQ, or other – for a profit, or at least in the hopes of it, it is done through an Initial Public Offering (IPO) in the primary market. Secondary market is where already existing securities change hands between investors.

Going public is a critical step in the life of a company. So, they hire investment bankers to guide them through the complex journey of raising money through IPO, for the penalties of making a wrong turn are stiff at this stage. A failed IPO can lead to livid investors and damage to market reputation. Morgan Stanley’s debacle of Facebook’s IPO ride is hard to omit from the public memory.

Investment bankers gauge if the company is ready to go public, and answer important questions, say:

New share issues are arranged by the investment bank or bookrunner, which determines the demand for a company’s shares through a roadshow and extensive marketing. It drums up investors’ interest, while also determining a price for the IPO based on investors’ sentiments. If the issuing company is large, a syndicate of banks comes together to share the underwriting risk, which simply speaking means, if the investors are unwilling to buy the shares, the investment bank will buy them. Thus, effectively, guaranteeing finance to the company.

IPO valuation is a tricky trip, but market sentiments and book building allow bankers to suggest a right call.

Investment bankers are useful, often pertinent, in identifying the sources of finance for seekers. Acquiring a sense of what the market wants and where it is headed is important for them. While all – hedge fund manager, risk manager, investment banker, day trader, Warren Buffet, and Amanda from the café next corner – learn about major market events at the same time, their ability to profit themselves and clients from it depends upon their understanding of the information. Hone your market meter by keeping an eye out for these indicators.

| The Big Picture | |

|---|---|

| IPO Market Update | High valuation and low market volatility are considered favorable conditions to go public. The IPO activity bottomed out after the financial crisis of 2008, but it recovered and saw the best of IPO window periods in all four quarters of 2017. Know the ‘right time’ to hit the market from periodic updates and analyses of the IPO market released by large investment banks, auditors, and other agencies. |

| Follow-on Market Update | When a listed company issue new shares after the IPO, it’s called Follow on Public Offering (FPO). It’s a common way to raise additional finances as investors usually are more forthcoming to support FPO given the public track record of the issuing company. This update can outline market optimism, or pessimism, for follow-on offerings. |

| Convertible Market Update | It refers to the bonds that convert to a predetermined number of stocks after a certain period. Convertible securities become a popular source of rescue capital for investors during an economic crisis. |

| Return on Equity (ROE) | Return on Equity is a measure of an entity’s efficiency in handling shareholders’ money. In IPO and other deals, a bank’s ROE can be compared with that of industry average to understand its performance for the investors. |

| Stock-Bond relationship | In normal market conditions, bond and stock prices share an inverse relationship. It’s a key indicator of market stability. Amid uncertainties, when both begin to fall, governments may launch stimulus packages. Also, if the balance is tilted in the favor of bonds, it represents low-risk appetite and confidence of investors. |

| Purchase of US Treasury by Fed (Open Market Operations or OMO) | When central banks buy more treasuries, interest rates usually fall, and often liquidity is injected into the system. It corresponds to a rally in the stock market. |

| Credit Spread | It measures the yield between US Treasury bonds and other debt securities of lower credit quality but same maturity. When the spread widens, it’s a warning sign for markets indicating US Treasury bonds are being favored over corporate bonds. |

| Major Indices – Sell or Hold | |

|---|---|

| S&P 500 | It is one of the most important indicators of stock market’s performance. This index tracks the stocks of 500 large- and mid-cap US companies, and report on their risks and returns. |

| Dow Jones Industrial Average | It is considered a strong indicator of market’s overall health. It tracks 30 largest US companies listed on the stock exchanges. Interestingly, the companies in Dow keep changing based on their performance. |

| Nasdaq Composite | It is an index of 2,500+ common stocks listed on Nasdaq – in a composition of about 50% technology, followed by consumer services, healthcare, and finance companies. |

| ISM Purchasing Manager's Index (PMI) | It’s a measure of manufacturing activity based on a monthly survey of 300 manufacturing firms in the US. |

| Trade Weighted Dollar Index | Created by the Federal Reserve, it is widely used by economists and currency analysts. Known as the broad index, it measures the value of US dollar in comparison to a broad group of major foreign currencies. |

| Sentiment Indicators – Bull(ish) or Bear(ish) | |

|---|---|

| Exchange-Traded Funds (ETF) | ETFs are a basket of securities that track popular indices and can contain all types of investments – bonds, commodities, or stocks. They trade on an exchange just like a stock but are low in expense and broker commission. A few popular ETFs include SPDR S&P 500 (SPY), iShares Russell 2000 (IWM), Physically-Backed ETFs, Commodity ETFs, Sector ETFs, and more. Heavy activity in ETFs represents a positive image of secondary market to the investors. |

| Bullish Percent Index (BPI) | It measures the number of stocks with bullish patterns. If BPI reading is 80% or above, the market sentiment is considered to be very optimistic, and when it’s below 20%, it indicates oversold and negative market sentiment. |

| High-Low Index | It compares the number of stocks that are making 52-week highs with the number of stocks making 52-week lows. When the index is below 30, it is considered that there is a bearish sentiment, and when the index crosses 70-mark, the market is considered bullish. This indicator can be applied to different indices. |

| Put-Call Ratio | This ratio gives information on an underlying security. When put buying is heavier than call buying, it signals a bearish sentiment. |

| Volatility or Fear Index (VIX) | It provides information on market expectations for volatility for the next 30 days. Rising VIX levels indicate market uncertainty. |

Capital Markets and Investment Banking (CIMB) industry is fronting a growing range of issues that can affect its future activities. Few of these challenges are comparatively recent and are approaching at a fast pace, which necessitates strategic choices. An outline:

Moving away from traditional ways of working is the biggest challenge for CIMB industry. It needs to explore new avenues of value creation to unlock revenue opportunities and identify novel sources of data to provide more information for valuation, market positioning and forecasting. Rethinking dated business models, and augmenting the pace of digitalization can invigorate bankers’ part in the capital market.

Rise of a slew of FinTech players is the biggest frenemies of global CIMB industry. These new players with fancy gadgets are disrupting capital markets from top to bottom. Among its recent manifestation is the rise of principal trading firms across electronically traded assets.

Companies now have multifarious sources of raising capital. As a result, the founders are delaying their plans to go public (Economist Intelligence Unit Survey Report of 2019). Instead, they are seeking debt and equity financing options in the private market, a chronic trend. However, most agree that going public is the ultimate destination for successful private companies. The process, though is being delayed now.

Economic conditions, regulatory landscape, and the odds of cyberattacks continue to be persistent external challenges for capital markets. Currently, the economic fallouts of COVID-19 are the most crippling. Bank of America’s Chief Investment Office has reported several V-shaped recoveries, but banks’ ROEs will take time to recover.

If the crème da la crème and legacy investment banks are to hold their ground, three imperatives, propagated by Boston Consulting Group, are pertinent to gain or retain a competitive advantage.

1. Be client-centric.

Most investment banks have been structured in silos that prevent them from offering a wider range of services to the clients. Traditional business model needs to be transformed into integrated services delivery to increase client profitability, broaden client base, and improve the efficiency of products. A Bank-as-a-platform model can be adopted where copious products and services are offered. The Capital Market and Investment Banking (CMIB) will benefit from adjoining with lending, transaction banking, asset servicing and clearing, group-level synergies, and wealth management.

2. Improve intelligence capabilities.

Bankers are best known for their intellectual capital. New age needs interweaving value creation with data and technology to improve the quality of intelligence provided to clients. The road to digital migration is rocky, but the results are rewarding. In the long-run, providers who dominate data intelligence will be better placed to own client relationship.

3. Reimagine tech architecture.

Giving up traditional legacy systems and adapting to a modern, flexible, and lightweight infrastructure is paramount for the previous two imperatives to work out. A new technology architecture focused on capturing clients’ needs will help bankers craft solutions in an informed manner. Just as Amazon offers recommendations to customers based on past behaviors. To begin with, a secure cloud operation must be built to lead the way for APIs and container-based applications.

If you prefer the sell-side and a blend between market and corporate banking, equity and debt capital market divisions will suit your taste. Industry leading certification in investment banking as offered from the Investment Banking Council of America offers industry-relevant curriculum encompassing deep knowledge of the markets, equity issues (IPOs) and recent trends, a grasp of indices performance, and foundational acquaintance required to steer you through cutthroat interviews and earn a spot in tight-knit investment teams.