Getting back in form from a crisis is a difficult journey to undertake. Still, “Be thankful that the road is long and challenging, because that is where you’ll find the best that life has to offer.” – Ralph Marston.

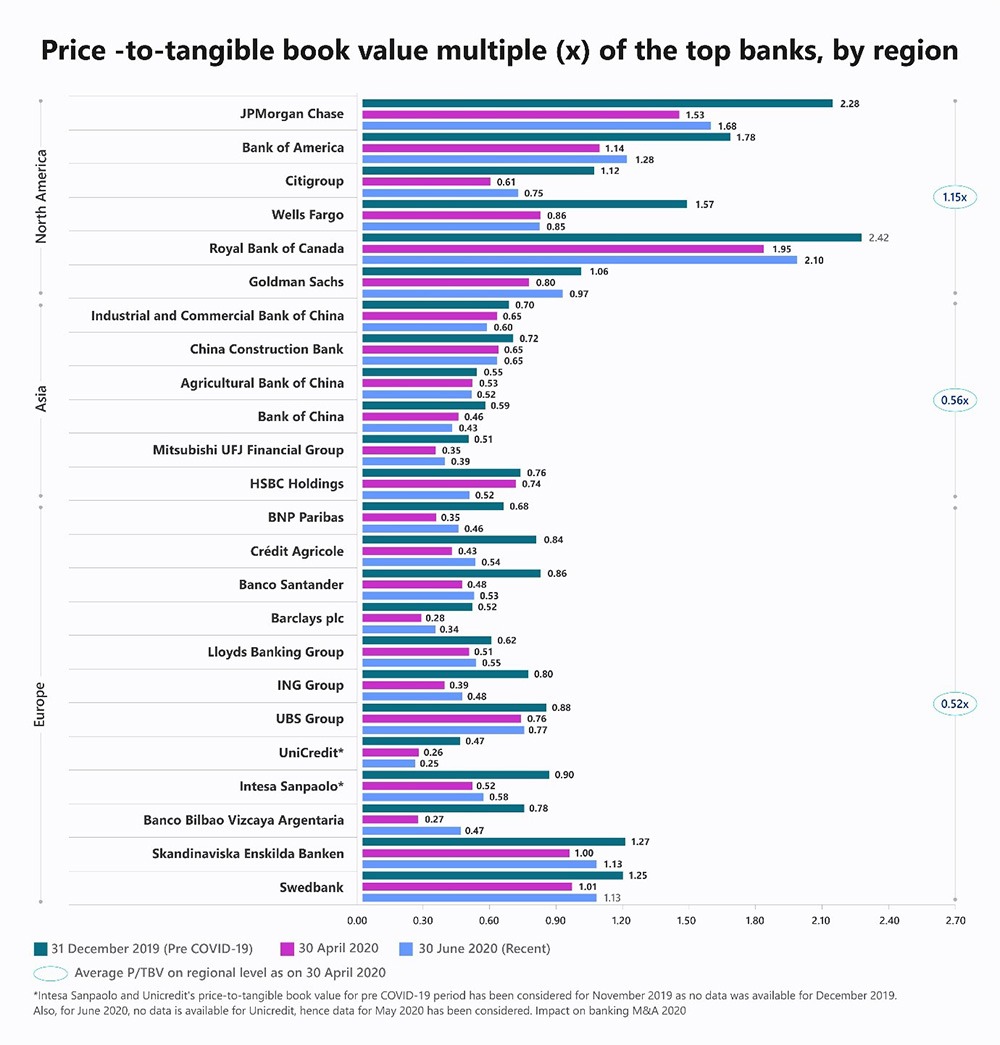

In the post-COVID world, the path will be challenging as COVID-19 has generated precariousness and high volatility in global capital markets. The valuations are dropping in all countries around the world. The prices per net asset value experienced a downfall from 1.00x to 0.69x as of 30th April 2020 as against 31st December 2019. The banking stocks saw a crash in mid-March.

However, effective warriors like Wells Fargo, Ameris Bank, Deutsche Bank, and BNY Mellon, among others, made the technology role a boardroom imperative and managed business continuity eminently.

In the wake of COVID-19:

Wells Fargo incorporated Artificial Intelligence (AI) and Machine Learning (ML) models into its standard model risk management policy. The project uses clustering algorithms to automate tasks that were traditionally given to junior analysts.

Ameris Bank uses AI and ML for anti-money laundering, financial crime detection, and fraud detection. Further, it uses natural language processing (NLP) to identify documents and classify elements.

Following the onset of COVID-19, BNY Mellon focused on the use of robotic process automation (RPA), intelligent automation, and AI from a business perspective i.e., in marketing and finance.

Deutsche Bank has managed business continuity amid the COVID-19 global crisis. It recommends a five-step business continuity health check to ensure robust defenses:

In brief, business leaders ought to expand business continuity and include ‘black swan’ events through automation with empathy as the workforce continues its recuperation. As they prepare for the return-to-work strategy and digital enablement of the workforce, it is essential to put these five plans into action.

Let us explore how investment banks can accelerate transformation in the wake of COVID-19. PricewaterhouseCoopers (PwC) outlines these 5 actions that investment banking must take to become stronger than before.

Build stronger customer loyalty and trust

Fortify commitments with government, business, controllers, and networks. Further, the capital markets must become innovative in supporting their customers, reallocating staff and assets while checking the strains on liquidity, financial impacts, straightforwardness, and meeting expectations on culture, administration, and risk management.

Create a lean, deft, and efficient operating platform

Balance the immediate imperatives of business continuity through the strengthening of remote work capabilities and mobilize resources for areas like acquisition financing. Also, it is crucial to avoid reverting to pre-crisis work culture and thought processes.

Bring nimbleness and resilience in operations

Modernize cross-channel management while upskilling staff to promote new ways of working and foster innovation. Harness existing digital transformation programs and accelerate investment in digital capabilities to reduce costs and risks and improve customer service.

Fulfil changing needs without extra cost

Accelerate modernization and redefine acquisition criteria for the post-COVID-19 situation. Explore the opportunities to expand distribution channels, identify fresh opportunities, manage the investor, and be realistic in establishing synergy expectations.

Respond to threats and opportunities while sustaining capabilities

Reconsider target and client division to decide their necessities, practices, and expectations. Additionally, survey expected effects on revenue, quicken innovation, and plan recuperation situations as needs arise.

Opportunities knock for differentiators who can reinvent strategies to gain a competitive advantage. To fortify operational versatility, accelerate digital transformation, and position your business for the new era, these action points could serve as great starting points. Navigate the crisis by capitalizing on new opportunities.