Compliance functions showed a major period of growth in the aftermath of the 2008 financial crisis. Despite this, the COVID-19 has pressurized investment banking firms and other financial institutions to improve efficiency. IBCA discusses how technology and people can help in this regard.

Compliance plays the central role in investment banking firms’ or any other financial institution's commitment to doing the right thing. The department of compliance in the financial services sector works to ensure that the business adheres to internal controls and external rules. They strive to protect investors, ensure transparency, make markets efficient, reduce systems risk and financial crime.

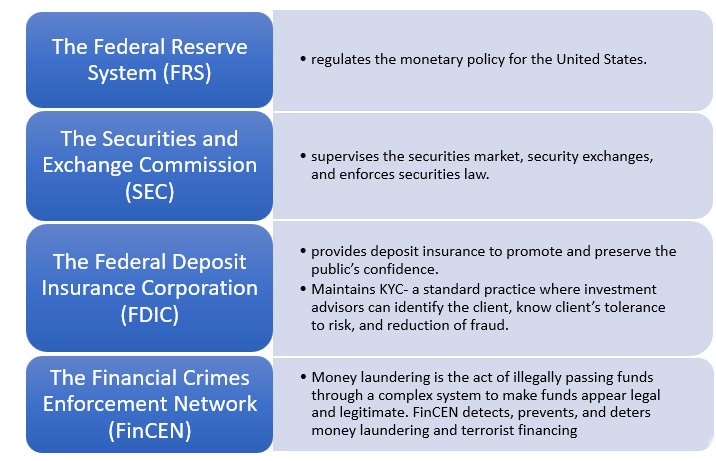

A few of the regulators in the United States financial system include:

Figure 1:Regulators in the United States financial system

Compliance functions are meant to support and challenge businesses efficiently, operate in a strategic and predictive capacity, lessen time in fire-fighting, revisit the mandates, reconsider the skillsets they hire and increase efficiency by using technology.

Though all these looks like simple math, there exist several gaps in compliance functions. To mention a few, they are:

Self-reporting: As the number of employees with access to material nonpublic information (MNPI) is high and also dispersed due to the pandemic, the compliance faculty may not know the employees who have access unless reported.

Absence of a mechanism for self-reporting: A proper mechanism for self-reporting does not exist in the system.

Absence of right tools: Though firms have robust databases on employee-related activity, there is the necessity of other information when investing a deal, and unfortunately that falls outside the firm’s primary system.

As the financial firms expand and more employees work remotely, proper implementation of technology can fill these gaps efficiently. Automation process should be done for the back-end office functions too along with front-office opportunities.

Mike Fay, Principal, Deloitte and Touche LLP says that the regulatory-ready organization should have three attributes:

A framework for risk assessment

A method to allocate resources

An experience of risks

Bringing people, processes, and technology together can close these widening gaps in compliance. It’s time to create a culture of compliance across the organization. Though it is a non-revenue generating part of the business, it reduces firms’ risk by protecting the revenue-generating side of the business. Implementation of technology helps to deliver efficient and effective compliance processes across the organization. The financial sectors including investment banks must -

Rely on technology that helps employees in reminding and facilitating reporting on the go.

Organize compliance activities and automate repetitive tasks if any.

Adoption of a three-pronged approach -involving people, processes, and technology will work wonders in the system.

Assessment of current competency skills against future operating model resource requirements is necessary. A review of the recruitment strategy to ward off traditional networks can help. Taking an innovative approach while resourcing and retaining talent is the need of the hour. It involves -

Compliance function capability: Bringing clarity to the roles and responsibilities as the demands are changing. Traditional skills must get augmented with new perspectives.

Compliance training: Creating a structured compliance curriculum to develop technical and behavioral skills. Internal job moves with training also stand as a good bet.

Process excellence is a mandate for considering technology solutions. Because only robust and accurate processes can set the real foundation for technology.

Reducing operational risk: Achieving an efficient process reduces operational risk and lessens rework resulting in standardization and fewer instances of risk appetite breaches. It also enables the integration of compliance assurance.

There exists a tendency to screw piecemeal solutions with legacy systems because removing an inefficient system seems to be expensive. But, in reality, the penalty imposed by the regulator would turn costlier when a breach occurs due to that inefficiency.

It is recommended to adopt the right technology rather than hanging onto temporary solutions. Robust technology solutions increase the reporting ability, governance, and thus mitigate risks.

Implementing robust technology solutions: Data and technology will improve the efficiency of compliance functions and drive an innovation-driven mindset. It supports the identification of events and risks through value-add analytics and insights, sound decision-making through strategic objectives.

Advanced analytics with a range of data-driven approaches can combine with business knowledge and highlight risks caused by large data volumes. Further, allocation of budget to explore regulatory technology should be on the prime line. Partnering with external providers and new entrants might be a simple solution.

Compliance is a part of the overall culture. It provides practical perspectives to translate regulations into operational requirements. The culture must encompass timely information sharing, escalation of emerging risks, and willingness to challenge the existing practices.

These expanded responsibilities would bring the required changes in the business practices and thrive well in the market. It mitigates unethical practices such as distorting transaction prices, misleading the appearance of public trading in a security, manipulating the market prices, concealing the magnitude of risk to a client, or pressurizing clients to buy or sell securities.

As an investment banking professional, stay updated with the compliance functions and solutions to carve your niche in the profession. Be a part of the culture of compliance.